Certified Content. A 40 minute watch.

During this episode we take a deep dive into adviser technology-related issues and how they are facilitating a ‘new normal’.

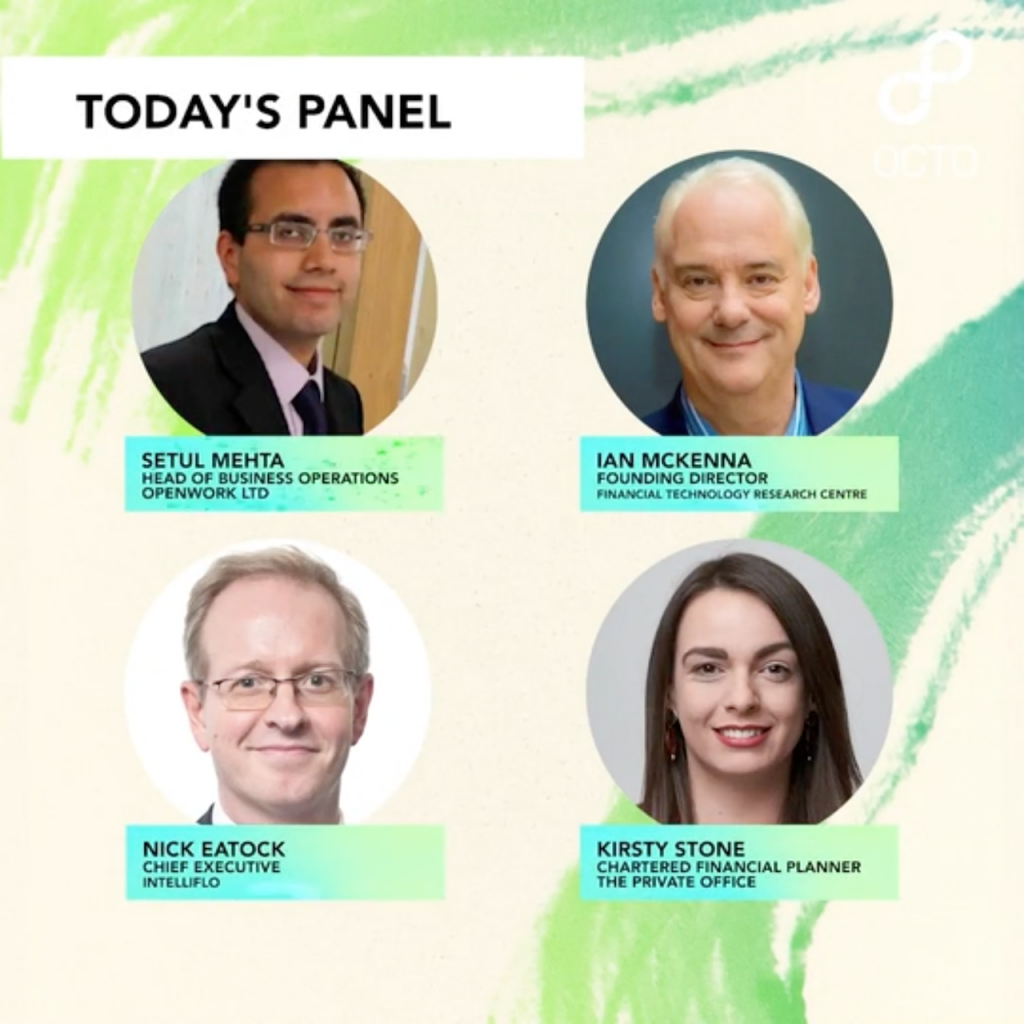

Our panel, hosted by Sam Shaw , will hear from:

Some of the many topics discussed include:

– The live testing of business continuity plans

– Balancing risk, cost and benefits of different technologies

– Risks posed by the providers’ lack of digitisation

– The importance of training and development

With over 17 years of financial services experience, my expertise focuses on Adviser Development, AUM, Mortgage Lending & Protection APE growth whilst keeping in line and ahead of industry regulation. Outside of work I enjoy spending time with my young family, a school governor, a keen sports fan and supporting the Openwork Care 4 Kids Foundation.

Kirsty is a Chartered Financial Planner at The Private Office. Within her role as an Adviser, Kirsty manages the investments and financial plans for a range of clients; ensuring they meet their financial goals and reviewing their overall financial wellbeing. Kirsty believes in providing bespoke advice tailored to the individual client; acknowledging that we all digest information in different ways and the presentation of financial advice must be adjusted to reflect this.

Nick founded Intelliflo in 2004, pioneering the use of web-based technology to support the end-to-end needs of financial advice businesses. Having worked for 30+ years in IT and 20+ years in financial services, Nick brings an extremely comprehensive blend of experience and knowledge to Intelliflo which has ensured that the business has remained at the forefront of technological and business innovation in the sector.

Ian founded Financial Technology Research Centre (FTRC) in 1995, nearly two decades before ‘fintech’ became part of the industry lexicon.

A boutique consultancy, the firm focuses on how personal finance organisations can communicate more effectively with their customers and help them take better financial decisions. FTRC works with many of the UK’s leading long-term savings institutions, financial advisers and technology providers to identify emerging technologies that can transform customer relationships.

Octo Members is the very first app-based private community for UK financial services professionals, where advisers, fund managers, wealth managers and professional consultants can come together to share knowledge and best practices.

CPD is a key element offered to our members who asked us to deliver actionable, contextual accredited content across all of our multimedia publishing.

In response to this we’ve created CPD Streams, carefully curated programmes of CPD episodes to address your learning needs.

Featuring hundreds of hours of quality CPD contained within constantly refreshed articles, podcasts, videos and supporting collateral; all designed to help you learn in the way you want to.

Our new programmes include:

…with more coming! So you’ll notice more and more content being accredited over the coming days and weeks.

We’re really excited about this enhancement to our member benefits, as we commit to ensuring Octo is your favourite resource to help you stay informed, meet your regulatory requirements, develop your professional capabilities and connect with the profession all via the very best engaging and insightful content.

The process to record your CPD couldn’t be simpler. Just watch or read your chosen piece of content, click ‘claim your CPD’ and your earned minutes will be logged via CPD Hub.

Introducing CPD Hub: The CPD platform for all your learning needs

CPD Hub is a free online solution created specifically to make it easier for financial professionals to earn, collect and record their annual CPD points. Whether you are an independent financial adviser or are responsible for managing your team’s CPD training, CPD Hub is here to help.

A next-generation learning ecosystem

CPD Hub make sure every learning opportunity counts; you can upload certificates earned elsewhere (i.e. events and seminars). So it’s easier and simpler than ever before to keep a record of all your CPD learning under one platform.

With CPD Hub its easy to keep your learning on track and the reporting tools allow you to demonstrate and share your progress with your accreditation body or employer.

Isn’t it time you streamlined your CPD learning? Find out more and sign up for free at www.cpdhub.co

Don’t forget, all 35 hours of your structured CPD including your 15 hours of IDD can be gained from digital resources, so what are you waiting for? Check out CPD Streams and start logging your CPD today!

There are numerous issues facing the industry and by sharing ideas (not business sensitive) we can promote best practice and improve the standing of our industry and profession.

Andrew HerbertsKeep up-to-date with news and views.

Rory PercivalViews on what’s going to make a difference in the months and years to come.

Clive Waller, Research ConsultancyWant to learn more? Contact us.

Get in TouchUK financial services professionals and those interacting in a professional capacity with financial services are invited to request to join this private community